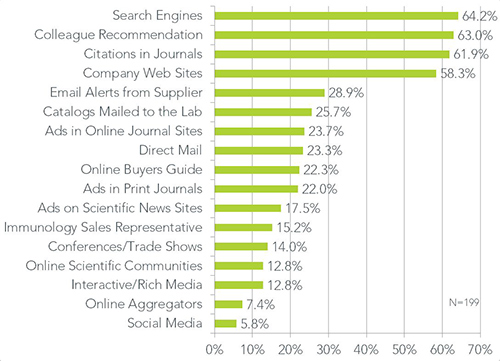

If you are looking for ways to communicate with researchers that identify themselves as immunology researchers, some of Percepta’s latest data suggests the popularity of various information sources spans a pretty broad spectrum. Search engines still rank high as a place immunologist look for product information. Also popular are peer recommendations, journal citations and company web sites, with more than 58% of immunology researchers specifying they access these four sources at least several times per month. Beyond these top tier sources, however, the percentage of researchers using additional immunology information sources drops off fairly quickly (see Figure).

The second tier includes supplier “email alerts”, which were cited by 29% of responding immunologists. Similarly, 22-26% of immunologists indicate they frequently use print journal ads, online buyers’ guides (e.g. www.biocompare.com, www.antibodyresource.com), direct mail, ads in online journal sites and supplier catalogs mailed to the lab as information sources.

For the third tier, far fewer (about 13%) indicate they frequently use interactive or rich media (e.g., webinars, YouTube videos, podcasts, product demonstration videos) and online scientific communities as information sources. And even fewer (less than 8%) immunologists indicate they frequently use social media (e.g. Facebook, Twitter, LinkedIn) or content aggregators (e.g. GenomeWeb, Fierce Biotech) for information sources.

We know through multiple studies on this topic that each source of information is accessed for a different purpose; some vehicles like “search” are better sources of finding/sourcing product information and others such as videos and webinars are preferred when making ultimate purchasing decisions. We also know the value of the information source changes depending upon whether the market is embryonic, developing or mature.

What does this mean for immunology product marketing? It reaffirms that is remains vital to take a broad approach to marketing to immunologists, continuing to invest in major communication vehicles such as corporate and product web sites of quality content. We believe that, though there is a gap in popularity, by no means is the top tier enough for acute information delivery. The second and third tier information sources are important for communicating specific types of immunology product information. If this is important to you but you think you may need more information feel free to contact us. We can help you pinpoint what immunologists want through a blind primary market research study that determines the range of attitudes and beliefs held by immunology researchers. Through our life science panel, you can query not just your customers but also those using competitor brands, which delivers results with more certainty.

[Note: in the data set in the Figure, green bars indicate the % of immunology researchers that utilize the information source frequently (at least several times per month) to constantly (several times per week)].

Leave a Reply